BTC Price Prediction: Technical Breakout and Fundamental Tailwinds Signal Path to $130,000

#BTC

- Technical Breakout Potential: Price above key moving averages with Bollinger Band squeeze suggesting imminent volatility expansion

- Fundamental Accumulation: Miner holding patterns and institutional adoption providing underlying demand support

- Macro Tailwinds: Dovish Fed expectations and potential regulatory adoption creating favorable environment

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Average

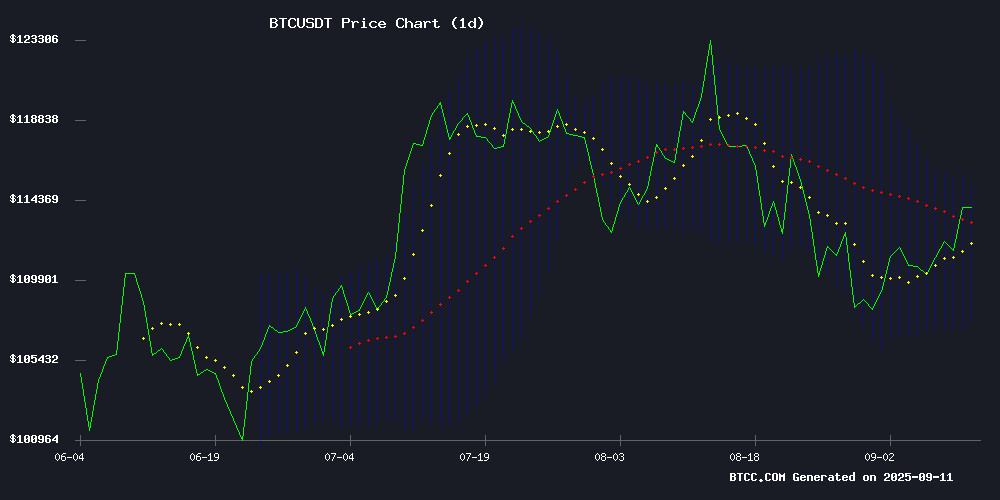

BTC is currently trading at $114,226.82, positioned above its 20-day moving average of $111,338.68, indicating sustained bullish momentum. The MACD reading of 1090.12 versus its signal line at 2310.47 shows some near-term consolidation, though the negative histogram suggests potential for short-term volatility. Price action remains within the Bollinger Band range of $107,547.11 to $115,130.25, with current levels testing the upper band resistance. According to BTCC financial analyst Emma, 'Maintaining above the $111,300 support level could pave the way for further upside toward the $118,000-$120,000 range.'

Market Sentiment: Accumulation Trends and Macro Support Bolster BTC Outlook

Recent news flow reinforces constructive technical positioning. Miner accumulation patterns suggest stronger conviction in the bull cycle continuation, while soft PPI data fuels expectations for dovish Fed policy—traditionally positive for risk assets like Bitcoin. The congressional exploration of strategic Bitcoin reserves and corporate treasury adoption (Tahini's case) provide fundamental support. However, rising mining difficulty and miner equipment disputes introduce some operational headwinds. BTCC financial analyst Emma notes, 'The combination of institutional accumulation and favorable macro conditions creates a supportive environment, though investors should monitor mining sector developments for potential volatility triggers.'

Factors Influencing BTC's Price

Bitcoin Miners Shift Strategy: Accumulation Over Selling Signals Stronger Bull Cycle

Bitcoin has retreated more than 10% from its August 2025 all-time high of $124,128 on Binance, yet on-chain data reveals miners are accumulating rather than dumping holdings—a structural shift that historically precedes major rallies.

The Miners' Position Index (MPI), which tracks exchange outflows relative to annual averages, shows none of the late-cycle sell-offs typical in previous bull markets. This divergence suggests suppressed selling pressure and potential fuel for the next leg up.

Analysts note the absence of pre-halving distribution patterns seen in prior cycles. Miners appear to be betting on higher prices rather than taking profits, echoing accumulation phases that preceded Bitcoin's 2017 and 2021 parabolic advances.

Bitcoin Faces Headwinds Amid Macroeconomic Shifts and Investor Diversification

Bitcoin's momentum has slowed in 2025, with the cryptocurrency down 6% over the past month and up only 20% year-to-date. This marks a stark contrast to its triple-digit returns in 2023 and 2024, signaling its weakest performance since 2022.

The pullback reflects growing sensitivity to macroeconomic conditions. Once prized for its uncorrelated returns, Bitcoin now moves in tandem with broader market anxieties—whether from slowing jobs growth, inflationary pressures, or trade tensions. Institutional adoption, while validating, has tethered BTC more closely to traditional financial headwinds.

Investors are also rotating into alternative crypto assets, fragmenting capital flows that once concentrated heavily in Bitcoin. This diversification suggests maturing market dynamics, though it dilutes BTC's dominance during risk-off periods.

Bitcoin Holds $113K Amid Soft U.S. PPI Data, Fueling Fed Dovish Hopes

Bitcoin maintains its $113,884 price level with daily trading volumes surpassing $56.3 billion, marking a 2.25% gain over the past 24 hours. The cryptocurrency's resilience follows an unexpected 0.1% month-over-month decline in the U.S. Core Producer Price Index (PPI) for August, contradicting forecasts of a 0.3% increase. Annual core inflation slowed to 2.8%, down from July's revised 3.4%.

Market participants interpret the weaker wholesale inflation data as a potential catalyst for Federal Reserve policy easing. The PPI surprise—the first monthly decline since April—shows services prices dropping 0.2% and goods inflation rising just 0.1%. Risk assets, including Bitcoin, benefit from receding inflationary pressures and shifting expectations toward a more accommodative monetary stance.

Bitcoin ETFs: Decoding Inflows, Outflows, and Market Impact

Crypto-based ETFs blend the volatility of digital assets with the structure of traditional funds, creating a complex interplay of capital flows. Inflows and outflows serve as barometers for fund health rather than direct performance indicators—money entering or exiting an ETF reflects investor sentiment more than asset valuation.

The relationship between these metrics and crypto prices often appears counterintuitive. Heavy inflows frequently coincide with bearish markets as investors seek regulated exposure, while outflows may signal profit-taking during rallies. This dynamic mirrors Gold ETF behavior during traditional market upheavals.

Market makers constantly rebalance ETF holdings, creating ripple effects across exchanges. Large inflows trigger fresh bitcoin purchases from custodians, while sustained outflows force liquidations—both scenarios creating price dislocations that savvy traders exploit across platforms like Coinbase and Binance.

Bitcoin Mining Difficulty Rises Amid Market Volatility

Bitcoin remains locked in a tug-of-war between bullish and bearish forces, with its price oscillating NEAR the $110,000 support level. Sellers continue to cap gains at $113,000, creating a narrow trading range that leaves traders questioning whether the next major move will be upward or downward.

Beneath the surface volatility, on-chain metrics reveal a network growing stronger. Mining difficulty continues climbing—a sign of robust infrastructure investment—while adoption metrics suggest steady long-term growth. This divergence between price action and network health underscores Bitcoin's resilience amid broader market uncertainty.

The mining ecosystem's persistent expansion, even during price fluctuations, demonstrates institutional confidence in Bitcoin's long-term value proposition. When macroeconomic pressures eventually ease, these strengthening fundamentals could propel the next sustained rally.

Bitcoin Shakeout Pattern Suggests Rally to $130,000 Ahead

Bitcoin's recent rebound from $110,000 support has crypto analyst CrypFlow identifying a classic shakeout pattern—a historical precursor to the asset's most aggressive bull runs. The setup suggests an imminent breakout toward $130,000, surpassing previous all-time highs.

Volatility marked the past 24 hours, with BTC dipping to $110,800 before recovering to $112,000. Weekly charts reveal a consolidation breakout attempt, mirroring past cycles where shakeouts preceded parabolic moves. "Bitcoin never trends higher in a straight line," observed CrypFlow, noting expansions consistently follow consolidation and shakeout phases.

Tahini’s Growth Strategy: From Hummus to Bitcoin Treasury

London, Ontario’s Tahini’s has transformed from a modest family-run Middle Eastern restaurant into a fast-casual franchise with an unconventional financial strategy—allocating corporate cash into Bitcoin. Founded in 2010 by two brothers, the business began receiving franchise requests within three years, prompting a shift toward scalable operations. The 2020 market turmoil cemented their Bitcoin treasury policy, framing it not as speculative trading but as a hedge against currency debasement and a funding mechanism for expansion.

Bitcoin’s role extends beyond finance, fueling brand storytelling and customer engagement. The founders’ deliberate approach mirrors institutional adoption trends, where crypto acts as both a reserve asset and a growth catalyst. Their story underscores how non-traditional industries can leverage digital assets for long-term resilience.

US Congress Explores Strategic Bitcoin Reserve in Landmark Bill

A legislative proposal before Congress could mark the United States' first formal step toward integrating Bitcoin into national fiscal strategy. The bill, H.R. 5166, directs the Treasury Department to assess the feasibility of creating a Strategic Bitcoin Reserve and Digital Asset Stockpile within 90 days of enactment.

The proposal requires analysis of custody solutions, security protocols, and balance sheet implications—signaling a potential shift from regulatory scrutiny to institutional adoption. Representative Joyce's filing comes as global central banks increasingly evaluate digital asset reserves.

Bitcoin-Gold Correlation Flips Negative as Markets Await Fed Decision

Bitcoin's 30-day correlation with gold has turned negative at -0.53, marking a significant divergence between the two assets. While gold remains stagnant near record highs, Bitcoin consolidates below $111,100, with strong demand absorbing sell pressure. A breakout above $114,100 could target $118,000 resistance.

Gold's inertia follows revised payroll data showing a historic 911,000 job loss, leaving traders awaiting inflation figures ahead of next week's Federal Reserve meeting. Market participants increasingly price in rate cuts despite policy uncertainty.

Geopolitical tensions compound market dynamics. Israel's unprecedented strike on Hamas leaders in Doha and former President Trump's tariff threats against China and India create additional volatility vectors. The precious metal's stability contrasts with Bitcoin's technical positioning as both assets respond differently to macroeconomic crosscurrents.

Bitmain Seeks Emergency Court Order to Reclaim 2,700 Bitcoin Miners from Orb Energy

Bitmain has filed an emergency motion in a U.S. bankruptcy court to reclaim 2,700 Antminer servers from Orb Energy, alleging misappropriation of digital assets and equipment damage. The Chinese mining hardware giant argues the machines—valued at over $5.5 million—should be excluded from Orb's Chapter 11 bankruptcy estate under their Hosting Sale Agreement.

The dispute reveals Bitmain's covert proprietary mining operations in the U.S., with court documents accusing Orb's CEO of diverting approximately $10 million in Bitcoin mining rewards to personal wallets. The motion claims Orb's leadership liquidated Bitmain's Bitcoin holdings ahead of critical court hearings while concealing transaction records.

Arkham Unveils Crypto Rich List — The Titans Behind $1.6 Trillion

Arkham Intelligence has published a ranked list of the 100 wealthiest entities in cryptocurrency, revealing a staggering $1.6 trillion in aggregated on-chain holdings. The data, current as of September 2, 2025, highlights the concentration of capital among exchanges, custodians, protocols, and prominent individuals.

Binance tops the list with $209.19 billion in assets, followed closely by Coinbase at $155.81 billion. The third position belongs to Satoshi Nakamoto's entity, valued at $125.07 billion—a reflection of early-mined BTC clusters tracked by Arkham. Institutional giants like BlackRock ($100.77 billion) and MicroStrategy ($53.21 billion) further underscore the deepening institutional footprint in crypto.

The methodology focuses on entity-level analysis rather than individual wallets, providing a clearer picture of true net worth. Each entry links to detailed Arkham Intel pages, allowing scrutiny of underlying addresses and asset compositions.

Is BTC a good investment?

Based on current technical and fundamental analysis, BTC presents a compelling investment opportunity for risk-tolerant investors. The price trading above key moving averages, combined with miner accumulation trends and supportive macroeconomic conditions, suggests potential for continued appreciation. Key factors to consider:

| Metric | Current Value | Implication |

|---|---|---|

| Price vs 20-day MA | $114,226.82 vs $111,338.68 | Bullish momentum intact |

| Bollinger Position | Near upper band ($115,130) | Testing resistance, breakout potential |

| MACD Signal | Negative histogram (-1220) | Short-term consolidation possible |

| Key Support | $111,300 | Critical level for bullish thesis |

BTCC financial analyst Emma suggests: 'While short-term volatility may occur, the combination of technical strength and fundamental tailwinds supports a positive medium-term outlook. Investors should consider dollar-cost averaging and maintain appropriate position sizing.'